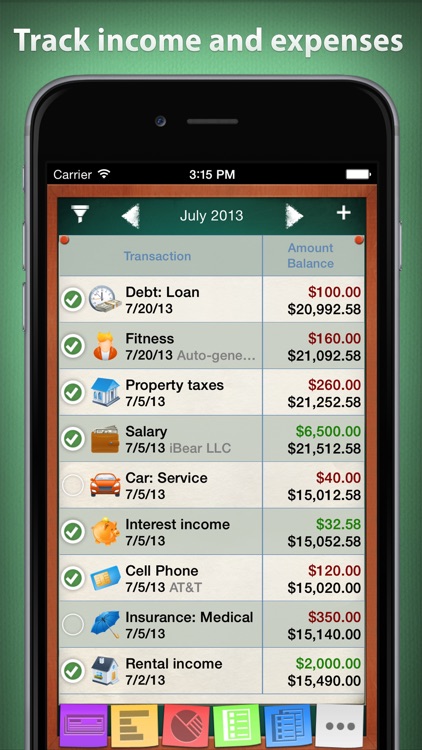

In-app brokerage and custody services are provided by DriveWealth LLC, member FINRA/SIPC. † Investment advisory services are provided by Ocho Investment Advisors LLC ("Ocho Advisors"), an SEC registered investment adviser. For example, if you buy and sell crypto or stocks frequently, it helps that you don’t have to contact your custodian every time you want to make an investment. It also makes sense if you make frequent investments that are time-sensitive. Having an LLC adds an additional layer of protection and privacy. Does a checkbook IRA LLC make sense for me?Ī checkbook IRA makes the most sense when you’re investing in real estate. With an IRA LLC, you have direct access to the funds through the LLC’s bank account. It’s a pain to have to contact your custodian each time you need to pay a bill or purchase supplies for your property. The most common investment through a checkbook IRA is real estate. Because you have an LLC, you have limited liability protection and more privacy in your investment.Ī real estate investment also requires more frequent use of your IRA’s funds. The only things you cannot invest in are collectibles, life insurance policies, and any prohibited transactions with disqualified persons. You can invest in traditional assets like stocks, mutual funds, and ETFs or alternative assets like real estate, crypto and private equity. You can invest in any asset class through an IRA LLC. Step 6: Fund the new LLC with the funds from your IRA. Step 5: Open a checking account under the LLC’s name. Step 4: Appoint yourself as the manager of the LLC. Step 3: Form a single-member LLC with your IRA as the sole member. You can choose to make contributions or rollover funds from another retirement account.

You can set up a self-directed IRA with any reputable custodian. Since you’re going to be making all your investment decisions on your own, you don’t need to find a specific custodian that offers the investment choices you want. Step 1: Open a self-directed IRA with a custodian of your choosing. Privacy: You can name your LLC whatever you want, giving you more anonymity when you invest in something. Protection: An LLC gives you limited liability protection, which can be especially helpful if you’re investing in real estate. But overall, if you make a lot of investments, it’s cheaper to invest through a checkbook IRA since you don’t have to rely on your custodian for every transaction. No transaction fees: Not all custodians charge transaction fees, and it depends on the investments you’re making. You don’t need to wait on your custodian to send the money every time you want to invest in something.

#Checkbook llc full

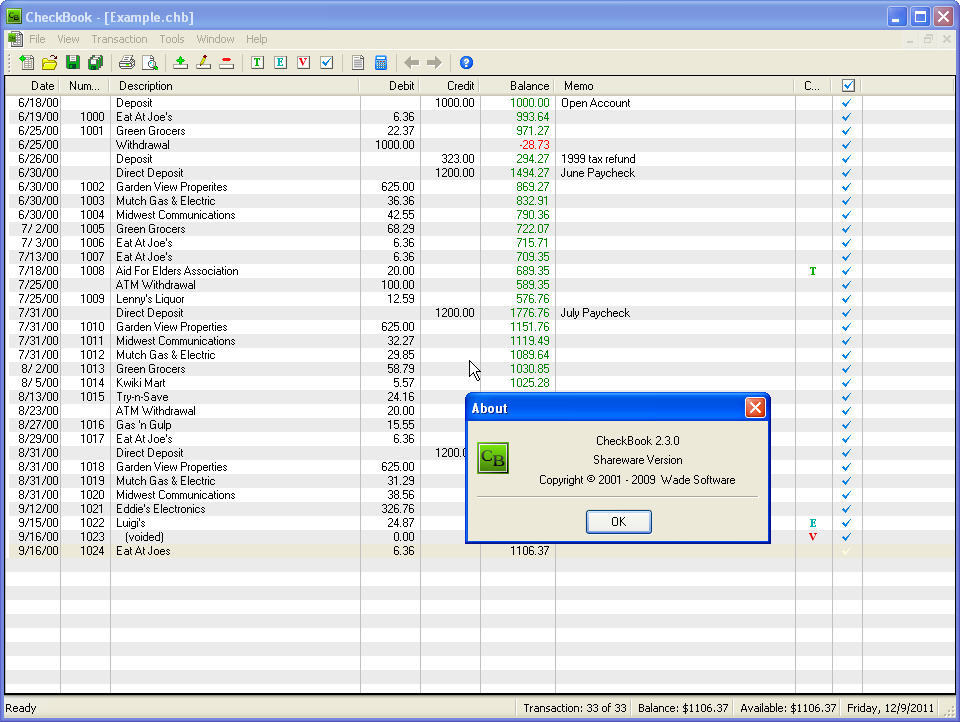

The main benefits of a self-directed IRA LLC are:Ĭheckbook control: You get full control over your investments. If you need to make contributions to your IRA, take distributions, or rollover funds, you would need to do it through your IRA custodian. You still need a custodian for your IRA, but with a checkbook IRA, they’re passive in nature and are only there in the background since the IRS requires that all IRAs have a custodian. Now, instead of making investments through your custodian, you can make investments directly through the funds in the LLC’s bank account. Instead of the custodian holding all of your IRA’s funds and assets, it all gets sent to the LLC’s checking account, where you control the checkbook.

Our Custodian names you the manager in the Operating Agreement.We form a single member LLC. Your IRA will be the 100% owner.

0 kommentar(er)

0 kommentar(er)